Malaysia’s

gloves manufacturing sector is of great interests to investors due to its

potential growth and profitability. Currently, Malaysia is the market leader in

medical gloves export with a commanding 63% of the total global demand,

followed by Thailand, China and Indonesia at 18%, 10% and 3% respectively. The

global glove demand rose from 268 billion in 2018 to 300 billion in 2019. In

2020 this demand is expected to reach 330 billion on the back of a surge caused

by the outbreaks of the COVID-19 pandemic.

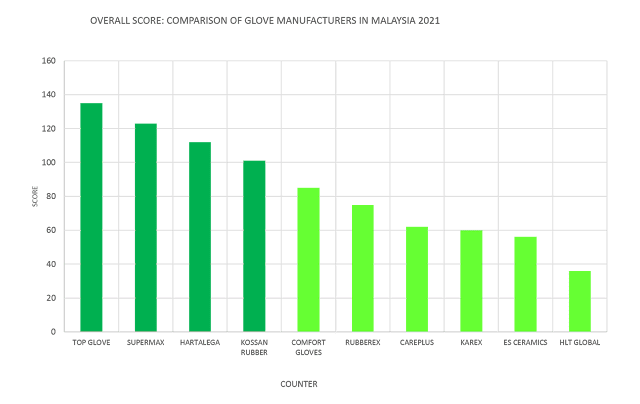

Below

is a comparison of 7 major gloves manufacturers counters listed in Bursa

Malaysia. These counters include TOP GLOVE, HARTALEGA, KOSSAN RUBBER, SUPERMAX,

COMFORT GLOVES, RUBBEREX and CAREPLUS. Also included in the comparison are

counters related to the gloves industry. ES CERAMIC manufactures ceramic hand

formers, HLT GLOBAL manufactures glove-dipping lines and KAREX is a condom

manufacturer with plans to begin gloves manufacturing. Comparisons of the

counters are made in terms of earnings, dividend return and efficiency of the

management. Scores are assigned to each indicator and added up together to

obtain an overall performance score for each counter, which gives an indication

of the gloves counters most worthy to invest in.

SECTION

1 – CURRENT EARNINGS, SHARE PRICE AND PRICE TO EARNING (P/E) RATIO

In terms of share price and earning per share, TOP GLOVE, SUPERMAX and HARTALEGA are the top three performers. As shown by the five-year earning per share trend, most counters show a sharp rise in earnings in FY 2020, resulted from increasing gloves demands. Most counters with good earnings show a price-to-earning ratio below 15, which indicates that they are relatively inexpensive to invest in.

SECTION

2 – DIVIDEND PER SHARE, DIVIDEND YIELD AND DIVIDEND PAYOUT RATIO

Dividend

payout by listed companies to shareholders is an additional return of

investment to shareholders in addition to the increase of share values.

Generous dividend payout to shareholders will attract more investors to invest

in the counter.

SECTION

3 – PERFORMANCE OF THE MANAGEMENT TEAM

The

long term success and profitability of the glove counters will depend of the

efficiency and smart strategies of the companies’ management team. Some of the

indicators offer some ideas on the strength of the management teams.

Among

the glove counters investigated, some of the better performing counters (e.g. TOP

GLOVE, SUPERMAX and HARTALEGA) posted a return on equity that is above 40% in

FY2020, meaning these counters are earning more profit per unit of capital

provided by the shareholders. The usual ROE for a good glove counter is

normally between 10-20%. In FY2020, due to the occurrence of the COVID-19

pandemic, the demand for medical gloves increased significantly, this in turn

led to better profitability and ROE of most of the glove counters. As all glove

manufacturers around the world ramp up their production output to meet the

rising demand, unit selling prices of medical gloves may gradually reduce and normalize.

Also

it is important that glove counters have the lowest possible cost-to-income

ratio, meaning it is able to control operational cost to the lowest level. Glove

counters generally incur high operational costs such a labour cost, energy

cost, raw material cost and so on. Well-managed counters employ strategies such

as increasing automation of the manufacturing process (to reduce reliance on

human labour), employ technological solutions for inventory management and

quality control and so on to reduce cost and improve earnings. Ideally the

cost-to-income ratio should be controlled to below 1000 to improve

profitability of the operations. Top manufacturers such as TOP GLOVE and

HARTALEGA have consistently be able to control cost-to-income ratio to around

200%, by improving workflow productivity, yielding greater outputs, higher economies

of scale and production efficiencies. In FY2020, in particular, most glove

manufacturers are achieving cost-to-income ratio of below 300%, due to increased

earnings in this financial year.

SECTION

4 – CASH AND ASSETS VALUES

SECTION

5 – MARKET CONFIDENCE ON THE COUNTERS

SECTION

6 – OVERALL PERFORMANCE AND SCORING OF THE GLOVE COUNTERS

NOTES:

**DATA BASED ON ROLLING 4 QUARTERS AS OF 14/2/2021 AND THE LATEST

PUBLISHED FINANCIAL REPORTS.

VOL: VOLUME, EPS: EARNING PER SHARE, NTA: NET TANGIBLE ASSET PER SHARE,

DPS: DIVIDEND PER SHARE,

P/E: PRICE EARNING RATIO, ROE: RETURN ON EQUITY, DY: DIVIDEND YIELD, DPR:

DIVIDEND PAYOUT RATIO

Latest

analysis reports of individual glove counters:

1.

TOP GLOVE CORPORATION BHD

https://louisesinvesting.blogspot.com/2021/02/comments-on-top-glove-corporation-bhd.html

2.

SUPERMAX CORPORATION BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-supermax-corporation-berhad.html

3.

HARTALEGA HOLDINGS BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-hartalega-holdings-berhad.html

4.

KOSSAN RUBBER INDUSTRIES BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-kossan-rubber-industries.html

5.

COMFORT GLOVES BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-comfort-gloves-berhad.html

6.

RUBBEREX CORPORATION (M) BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-rubberex-corporation-m.html

7.

CAREPLUS GROUP BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-careplus-group-berhad-0136.html

8.

KAREX BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-karex-berhad-5247-update.html

9.

ES CERAMICS TECHNOLOGY BHD

https://louisesinvesting.blogspot.com/2021/02/comments-on-es-ceramics-technology-bhd.html

10.

HLT GLOBAL BERHAD

https://louisesinvesting.blogspot.com/2021/02/comments-on-hlt-global-berhad-0188.html

Disclaimer:

The content of the blog posts are for sharing purpose only. Readers are

encouraged to carry out further research and analysis as well as follow up

latest update information before making any investment decisions.

No comments:

Post a Comment